Oregon quarterly tax report to amend

Payroll often influences business owners and managers to minimize recruiting because they believe hiring an employee complicates business and increases risks.

It's not a wonder considering the ever changing paperwork requirements, laws, forms, payroll tax rates and deadlines.

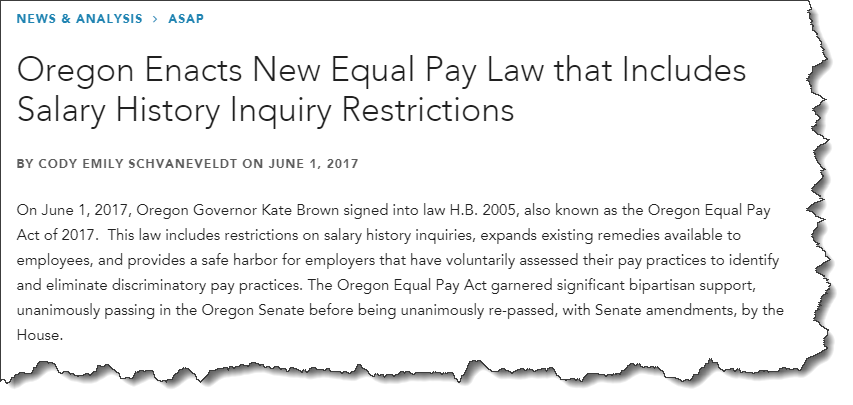

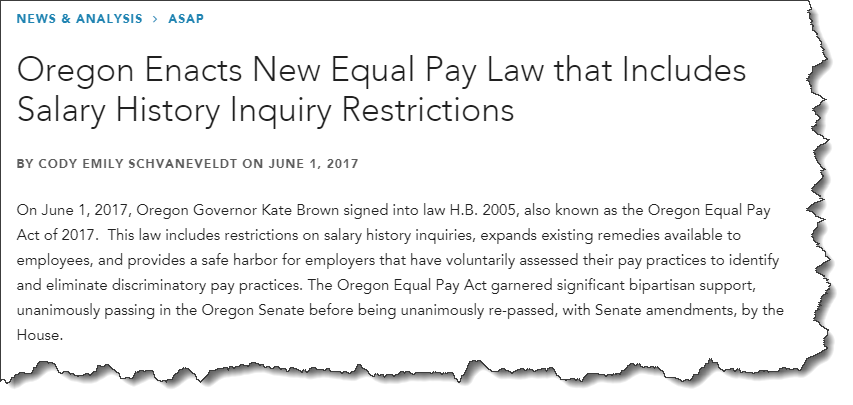

Meeting both the Federal and state employer requirements requires a commitment beyond the capabilities of many multi-hat managers. For example, Oregon recently enacted a new law that includes salary history inquiry restrictions.

- Employers may not ask an applicant how much s/he is currently paid.

- Employers may not base a new hire’s pay on that individual’s current or past compensation

- Employers may not comply with the Equal Pay Act by cutting a current employee’s pay.

The resources below should help you to better understand payroll tax requirements and deadlines.

Before hiring an employee, create a plan to get them paid. Include these in your plan:

- Get an Employer Identification Number (EIN)

- You will need to register with the Oregon Employment Department. You can register quickly and securely on the State of Oregon Central Business Registry site.

- Decide if you want an independent contractor or an employee

- Choose an in-house or external service for administering payroll – We provide payroll services!

- Decide who will manage your payroll system – We can manage your payroll system!

- Obtain worker’s compensation insurance

- Ensure new employees return a completed W-4 form & I-9

- Make sure they’re eligible to work in the U.S. – (or face fines)

- Schedule pay periods to coordinate tax withholding for IRS

- Create a compensation plan for holiday, vacation and leave

- Know what records must be kept on file and for how long

- Federal requirements are different from state requirements.

- Choose a payroll method - how will you pay your employees?

- Display required workplace posters (Oregon requirements here)

- Report payroll taxes as needed on a quarterly and annual basis

The IRS maintains the Employer’s Tax Guide, which provides guidance on all federal tax filing requirements that could apply to the obligations for your small business. Check with your state tax agency for employer filing stipulations.

Oregon State Resources

All employers with paid employees working in Oregon must register for a business identification number (BIN) to report and pay Oregon payroll taxes. Corporations without employees must also register to report compensation paid to corporate officers.

Oregon uses a Combined Payroll Tax Reporting System to report all payroll taxes together. The BIN serves as the employer's account number when reporting payroll taxes.

Before you hire

Register online for a BIN using the Oregon Business Registry or by submitting a Combined Employer's Registration form. You must register before issuing any paychecks. Learn more about BINs.

Know the law

- 1st quarter, due April 30.

- 2nd quarter, due July 31.

- 3rd quarter, due October 31.

- 4th quarter, due January 31.

Payments

Payroll tax payments are due the last day of the month following the end of the quarter. Unemployment tax payments only for annual domestic employers are due January 31 of each year. Employers required to deposit state withholding once each month or more may also include a payment for unemployment insurance tax.

If all money owed or reports required are not received by the Employment Department prior to September 1, of each year, an additional penalty of 1% of the previous year’s taxable payroll will be assessed.

- Oregon Tax Employer Reporting System (OTTER) electronic filing.

- Secure Employer Tax Reporting System (SETRON) electronic filing.

- Combined Payroll Tax Reports Form OQ.

- Interactive voice response system, call (503) 378-3981. Use only to report quarters with no payroll or no hours worked.

Year-end reconciliation information

You must file an Oregon Annual Withholding Reconciliation Report, Form WR, even if you submit your W-2 information electronically. Form WR is due January 31 in the year after the tax year. If you stop doing business during the year, the report is due within 30 days of your final payroll. You can file this form electronically through Revenue Online.

Update your business information

Make updates to addresses and phone numbers or change offsite payroll services using the Business Change in Status form, or online using the Central Business Contact Change form.

- Changing from a sole proprietor to a partnership or corporation.

- Changing from a partnership to sole proprietor.

- Adding or removing a spouse as liable owner.

- Changing from any business structure type to a limited liability corporation (LLC).

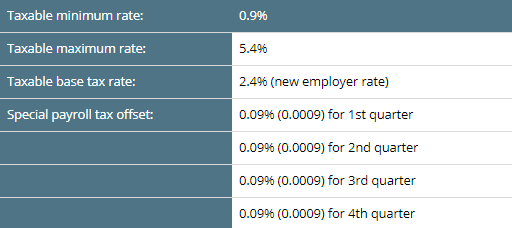

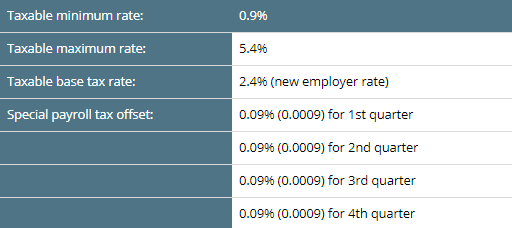

2018 Tax Rates

The tax rates for Tax Schedule III are as follows:

Order Forms

Forms for filing payroll taxes by paper cannot be downloaded.

They must be ordered from the Employment Department.

Forms Available to Download:

- 2017 Domestic Payroll Booklet 2017 payroll tax reporting instructions for Oregon domestic employers.

- 2017 Domestic Plain Paper Specifications Specifications for the plain paper format of the Form OA and Form 132 Domestic Employee Detail Report.

- 2017 Employer’s Filing Due Dates & Misc. Contact Information (UI Pub 139) 2017 Employer’s Filing Due Dates & Misc. Contact Information (UI Pub 139)

- 2018 Combined Payroll Tax Reporting Instruction Booklet 2018 Payroll tax reporting instructions for Oregon employers.

- 2018 Employer's Filing Due Dates & Misc. Contact Information (UI Pub 139) 2018 Employer's Filing Due Dates & Misc. Contact Information (UI Pub 139)

- 2018 Missing Data Instructions OTTER2018

- 2018 Plain Paper Specifications Specifications for the plain paper format of the Form OQ, Schedule B, and Form 132 Employee Detail Report.

- Agricultural Employers (UI Pub 210) Payroll tax information pertaining to agricultural employers.

- AMENDED REPORT: Form 132 Use the Form 132 Amended Report to make adjustments to wages and hours reported on Form 132. Use this form even if you filed the original report electronically.

- AMENDED REPORT: Form OQ/OA Amended Use the Form OQ/OA Amended Report to make adjustments to taxes reported on Form OQ or OA (Domestic) reports. Use this form even if you filed the original report electronically.

- AMENDED REPORT: Instructions for Form 132 Amended Instructions on how to use the Form 132 Amended.

- AMENDED REPORT: Instructions for Form OQ/OA Amended Instructions on how to use Form OQ/OA Amended.

- AMENDED REPORT: Notice of SSN Change/Correction Form Use this form in notify the Department of SSN corrections or changes necessary for your payroll tax reporting.

- AMENDED REPORT: Schedule B Amended

- Authorization for Tax Withholding (Form 1040WH) This document is used by unemployment insurance claimants to authorize the withholding of taxes from their unemployment insurance benefit payments.

- Business Change in Status (Form 013) Use this form to update business status such as entity changes, ownership changes, name changes, etc.

- Business Contact Change Form Use this form to update your business contact information. This includes address and phone number updates, and offsite payroll service/accountant/bookkeeper updates.

- Change in Business Entity (UI Pub 212) This informational flier covers the topic of status changes employers need to report and how to report them.

- Combined Employer's Registration (Form 055) Use this form to register your business for Combined Payroll Tax Reporting purposes. You can also register online with the Central Business Registry (CBR) at http://sos.oregon.gov/business/Pages/register.aspx.

- Corporate Officer Exclusion Form 2578 - English Corporate Officer Exclusion request UI Tax form.

- Corporations and Limited Liability Corporations (UI Pub 208) Corporations and Limited Liability Corporations (UI Pub 208)

- Domestic Employers (UI Pub 207) This informational flier covers payroll topics for domestic employers only. The definition of a domestic employer is included in this flier.

- Employer Rights & Responsibilities (UI Pub 215) This informational flier covers your rights and responsibilities as an employer subject to Unemployment Insurance law in Oregon.

- Employer, Employee and Wages (UI Pub 205) This informational flier covers definitions related to employers, employees and wages as they pertain to Employment Department law.

- Excess Wage Computation (UI Pub 217) This informational flier covers the taxable wage base and how excess wages are defined for employers.

- Experience Rating Benefit Ratios for 2015 (UI Pub 8) This table shows benefit ratio groupings and the assigned tax rates for 2015.

- Experience Rating Benefit Ratios for 2016 (UI Pub 8) This table shows benefit ratio groupings and the assigned tax rates for 2016.

- Experience Rating Benefit Ratios for 2017 (UI Pub 8) This table shows the benefit ratio groups and the assigned tax rates for 2017.

- Experience Rating Benefit Ratios for 2018 (UI Pub 8) This table shows the benefit ratio groups and the assigned tax rates for 2018.

- Hours and Estimating Hours Worked (UI Pub 211) Use the following guidelines to help you estimate hours worked if your payroll system does not track hours.

- How UI Tax Rates Are Determined (UI Pub 214) This informational flier explains how payroll tax rates are assigned in accordance with Oregon law, and how the benefit ratio is calculated.

- Independent Contractors (UI Pub 201A) This is an informational flier that covers the topic of Independent Contractors.

- Multi-state Employment (UI Pub 209) This informational flier covers the topic of employees who perform services in Oregon as well as in other states, and how this applies to reporting payroll taxes.

- Nonprofit Employers (UI Pub 206) This informational flier covers topics related to nonprofit employers.

- Notice of Election Form Notice of Election to cover employees not covered by Oregon Employment Department law.

- Quarterly Due Dates and Contact Information Sheet (UI Pub 139) 2018 Employer’s Filing Due Dates & Misc. Contact Information (UI Pub 139)

- Questions and Answers about UI Tax Audits (UI Pub 203) This informational flier answers common questions regarding Payroll Tax audits.

- Restaurant and Bar Industry (UI Pub 202) This is an informational flier that provides general information on certain types of employment and compensation in the restaurant and bar industry.

- RUSSIAN: Independent Contractors (UI Pub 201A) This is an informational flier that covers the topic of Independent Contractors.

- SPANISH: Agricultural Employers (UI Pub 210) Payroll tax information pertaining to agricultural employers.

- SPANISH: Authorization for Tax Withholding Authorization form allowing the Oregon Employment Department to withhold funds from unemployment insurance benefits for state or federal tax purposes. Can also be used to have the department stop withholding funds.

- SPANISH: Change in Business Entity (UI Pub 212) This informational flier covers the topic of status changes employers need to report and how to report them.

- SPANISH: Corporations and Limited Liability Corporations (UI Pub 208) SPANISH: Corporations and Limited Liability Corporations (UI Pub 208)

- SPANISH: Domestic Employers (UI Pub 207) This informational flier covers payroll topics for domestic employers only. The definition of a domestic employer is included in this flier.

- SPANISH: Employer Rights & Responsibilities (UI Pub 215) This informational flier covers your rights and responsibilities as an employer subject to Unemployment Insurance law in Oregon.

- SPANISH: Employer, Employee and Wages (UI Pub 205) This informational flier covers definitions related to employers, employees and wages as they pertain to Employment Department law.

- SPANISH: Excess Wage Computation (UI Pub 217) This informational flier covers the taxable wage base and how excess wages are defined for employers.

- SPANISH: Family Corporate Officer Exclusion Request (Form 2578) Requests for Family Corporate Officer Exclusion (Form 2578) cannot precede a Combined Employer's Registration (Form 055). We will accept and process both forms concurrently.

- SPANISH: Hours and Estimating Hours Worked (UI Pub 211) Use the following guidelines to help you estimate hours worked if your payroll system does not track hours.

- SPANISH: How UI Tax Rates Are Determined (UI Pub 214) This informational flier explains how payroll tax rates are assigned in accordance with Oregon law, and how the benefit ratio is calculated.

- SPANISH: Independent Contractors (UI Pub 201A) This is an informational flier that covers the topic of Independent Contractors.

- SPANISH: Multi-state Employment (UI Pub 209) This informational flier covers the topic of employees who perform services in Oregon as well as in other states, and how this applies to reporting payroll taxes.

- SPANISH: Nonprofit Employers (UI Pub 206) This informational flier covers topics related to nonprofit employers.

- SPANISH: Questions and Answers about UI Tax Audits (UI Pub 203) This informational flier answers common questions regarding Payroll Tax audits.

- SPANISH: Restaurant and Bar Industry (UI Pub 202) This is an informational flier that provides general information on certain types of employment and compensation in the restaurant and bar industry.

- SPANISH: Tax Authorization Representative Form This form allows the Employment Department to disclose your company’s confidential tax information to your designee. You may designate a person, agency, firm or organization.

- SPANISH: Volunteers (UI Pub 176) This informational flier explains the definition of volunteer as it pertains to Unemployment Insurance law.

- Tax Authorization Representative Form This form allows the Employment Department to disclose your company’s confidential tax information to your designee. You may designate a person, agency, firm or organization.

- VIETNAMESE: Independent Contractors (UI Pub 201A) This is an informational flier that covers the topic of Independent Contractors.

- Volunteers (UI Pub 176) This informational flier explains the definition of volunteer as it pertains to Unemployment Insurance law.

There is more but this covers the basics.

Payroll is more complicated than ever. Employees are suing their previous employers based on non-payment, overtime, discrimination, and other reasons that requires recordkeeping excellence.

If you are attempting to manage your own payroll internally and have areas of concern, please contact Eric Moore at Accounting Solutions Partners. Eric can help you identify your needs, outline a plan and help you get started with new payroll or bookkeeping services. Your plan may include onsite, offsite or a combination.

Note: This content contains general information and guidance only. It is not a substitute for legal or tax advice. For advice specific to your area or business, be sure to consult with a qualified professional.