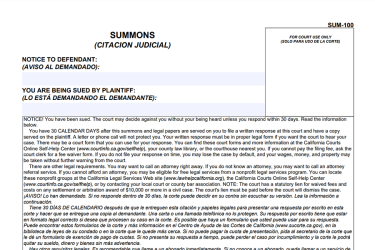

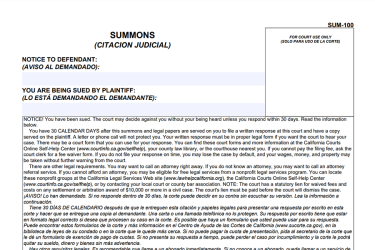

If you receive a form called a Summons (SUM-100) it means that someone is suing you in court. In addition to the Summons, you'll also receive another document, called a Complaint. The Complaint describes the details of the case against you.

This page will help you understand the Summons and Complaint if you're being sued for a debt, and describe some options for what to do next if you are being sued for debt including debt from credit cards, student loans, car loans, and medical bills

PRINT EMAIL

The summons shows the name of the person or company who is suing at you at the top. They are the Plaintiff.

What if I don't recognize the name of the Plaintiff?If you don't recognize the name of the company, it could be because a company bought your debt from the original lender. For example, your credit card or hospital where you had care sold your debt. The debt buyer will be listed as the Plaintiff if they are suing you for the original debt.

The attached Complaint will tell you more about the Plaintiff, like if they are a debt buyer and what they are claiming.

You should see your name as the Defendant - the person who is being sued. You should also check to make sure that this is actually you. Sometimes wrong person is served with papers because they have the same name or a similar name as someone else.

You will not go to jail for having an unpaid consumer debt or losing a court case to a debt collector

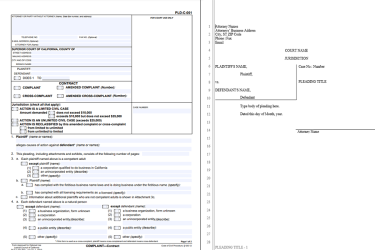

To find out what you're being sued for, look at the Complaint. This will either be on a form titled Complaint – Contract (form PLD-C-001) or typed up in a specific legal format where each line is numbered (called pleading paper).

The Complaint will list the names of the Plaintiff and Defendant (you) and will also name the Plaintiff's attorney.

The information about Jurisdiction describes what kind of case it is, based on the amount of money the Plaintiff is asking for. Different court rules and fees apply to different types of cases.

The amount of money the Plaintiff is asking for is called Damages. You may also see it described as the prayer amount. This is the amount you owe. It can include costs to cover court fees and attorney's fees.

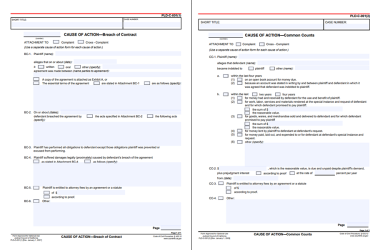

The Complaint - especially if it is typed up on pleading paper - will go into detail about what you are being sued for, using specific legal terms called Causes of Action. This is how the Plaintiff describes to the court why, by law, they believe they have the right to sue you. In court, they have to prove the Cause of Action is true.

These are the most common Causes of Action used in debt lawsuits:

Your complaint may also list other Causes of Action.

The Complaint may also include attachments, like copies of account statements or other document that will help you understand what the Plaintiff is claiming.

You have 30 calendar days from the date you were served to respond if you want to defend yourself in court. After the 30 days have passed, you might still be able to respond, but if the other side files a "Request to Enter Default" before your response, you may be prevented from disputing the debt or amount owed in court

Do nothing The Plaintiff will win the case and you'll have to pay the debt. This is called a default. The debt collector may be able to take the money from your wages or bank account.

Pay the debt to get the case dismissed If you can pay off the debt now, you'll need to also ask the Plaintiff to dismiss case.

Try to negotiate a settlement Sometimes the debt collector will agree to a payment plan or take less than the amount owed. Always get the agreement in writing. If you decide to negotiate, you may still file a response in court.

Respond and defend yourself in court If you respond by filing papers in court, the Plaintiff will have to prove you owe the debt in a court case.